Written by Yanis Kharchafi

Written by Yanis KharchafiCommunal income taxes in Valais

When talking about the canton of Valais, the first things that might pop into one’ s mind are the 4,000-meter-high peaks, the breathtaking (and ligament-cutting) ski slopes or the small villages full of genuine raclette cheese. But many others also think of its supposedly rather generous tax system.

You most likely have already heard from a colleague, a friend or this old cat-lady from the ground-floor: “Snow, Sun and Spas, he said! What a coincidence, he for sure meant savings. Tax savings!”

Do you live in Valais? Or would you like to follow the path of all those who enjoy its high-peaks and low-tax landscapes?

Let’s navigate together the Valaisan tax burden waters. Remember, there are 3 taxation layers. This paper will only address one aspect of the taxes in Valais, namely the communal taxes. If interested in the cantonal, federal or wealth taxes, please refer to our dedicated articles. If you would like us to prepare your tax return for the Valais, don’t hesitate to contact us.

The line-up:

Step 1: Find out your taxable income in Valais

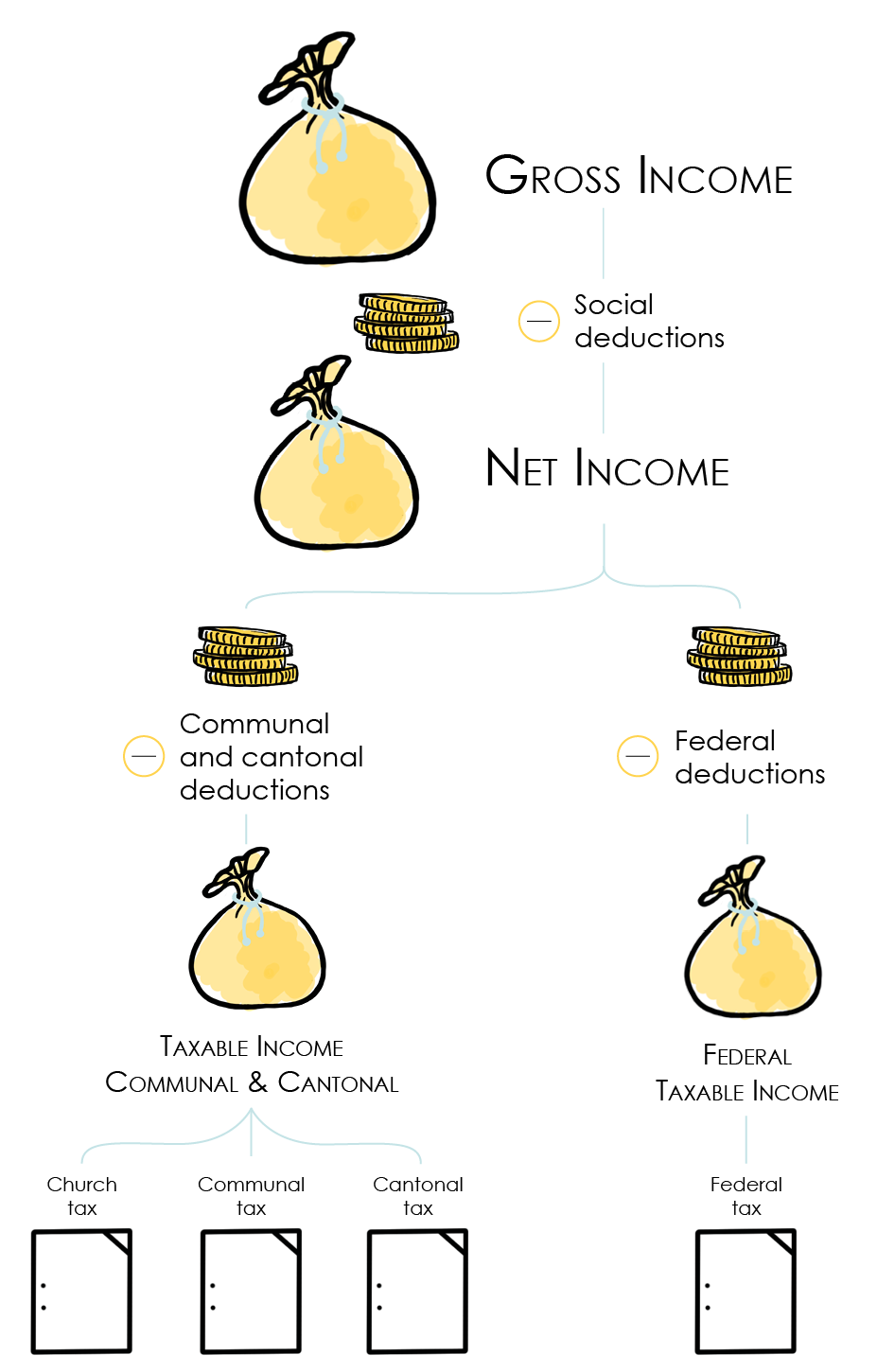

Of course, each canton has its own specificities, but essentially the flow is comparable to all others. I therefore invite you to read our article on taxable income or alternatively, below is a pictorial summary:

In Switzerland, employment contracts are always based on a gross salary. This gross salary is then reduced by social contributions, including:

- AVS (1st pillar)

- Unemployment insurance (AC)

- Family insurance

- Basic and supplementary accident insurance (LAA – LAAC)

- 2nd pillar (Occupational pension – LPP)

- Etc.

Once your net salary is calculated, it will be transferred to your account. Over the months, these amounts will accumulate, and at the end of the year (or rather at the beginning of the following year), you will receive a salary certificate summarizing these amounts, including your annual net salary. This document serves as the starting point for determining your taxable income, as all social contributions are deductible.

After calculating your salary, Swiss tax laws allow for certain deductions (standard or actual) that can further reduce your net income to determine the taxable income. A small clarification: although Swiss tax laws are generally applied across all cantons, each canton has the flexibility to interpret and adapt these laws to their specific guidelines. As a result, taxable income at the cantonal level often differs from the taxable income at the federal level.

Do you pay a lot of taxes in the canton of Valais?

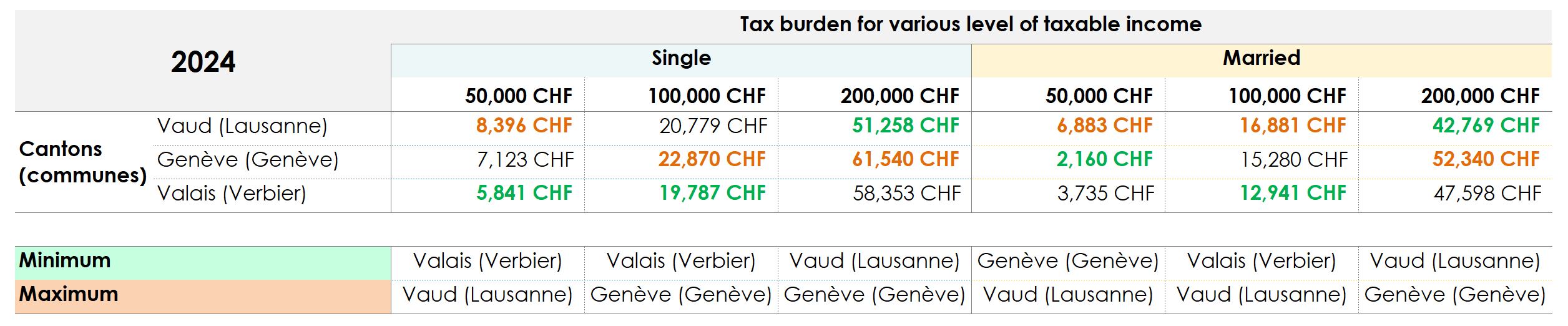

This is the most frequently asked question from our clients: Should I move to Valais to lower my tax burden? Rather than answering this question outright, I invite you to explore the facts and decide for yourself.

The easy conclusion would be to say that Valais is never mentioned among the “worst cantons,” but it also doesn’t consistently win the title of “best canton.” Moreover, as you’ll discover later in this article, Verbier stands out as the least expensive municipality in Valais. In other words, had we chosen other municipalities, the results could have been quite different.

The most honest conclusion, therefore, would be: it depends…

Now that we’ve laid the groundwork, let’s dive into the details of calculating municipal taxes.

Step 2: Municipal Indexation (Previously Covered in Cantonal Taxes)

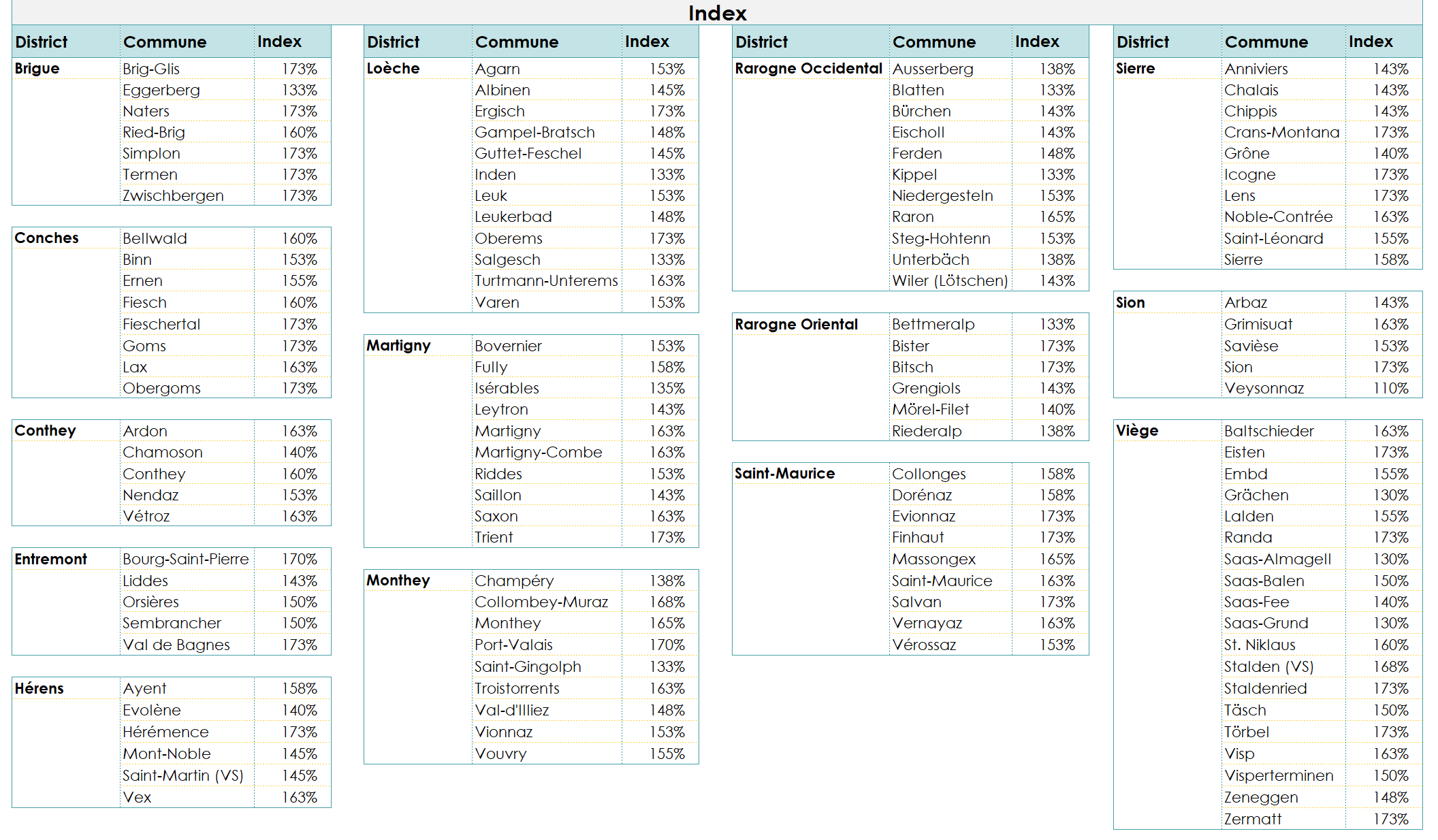

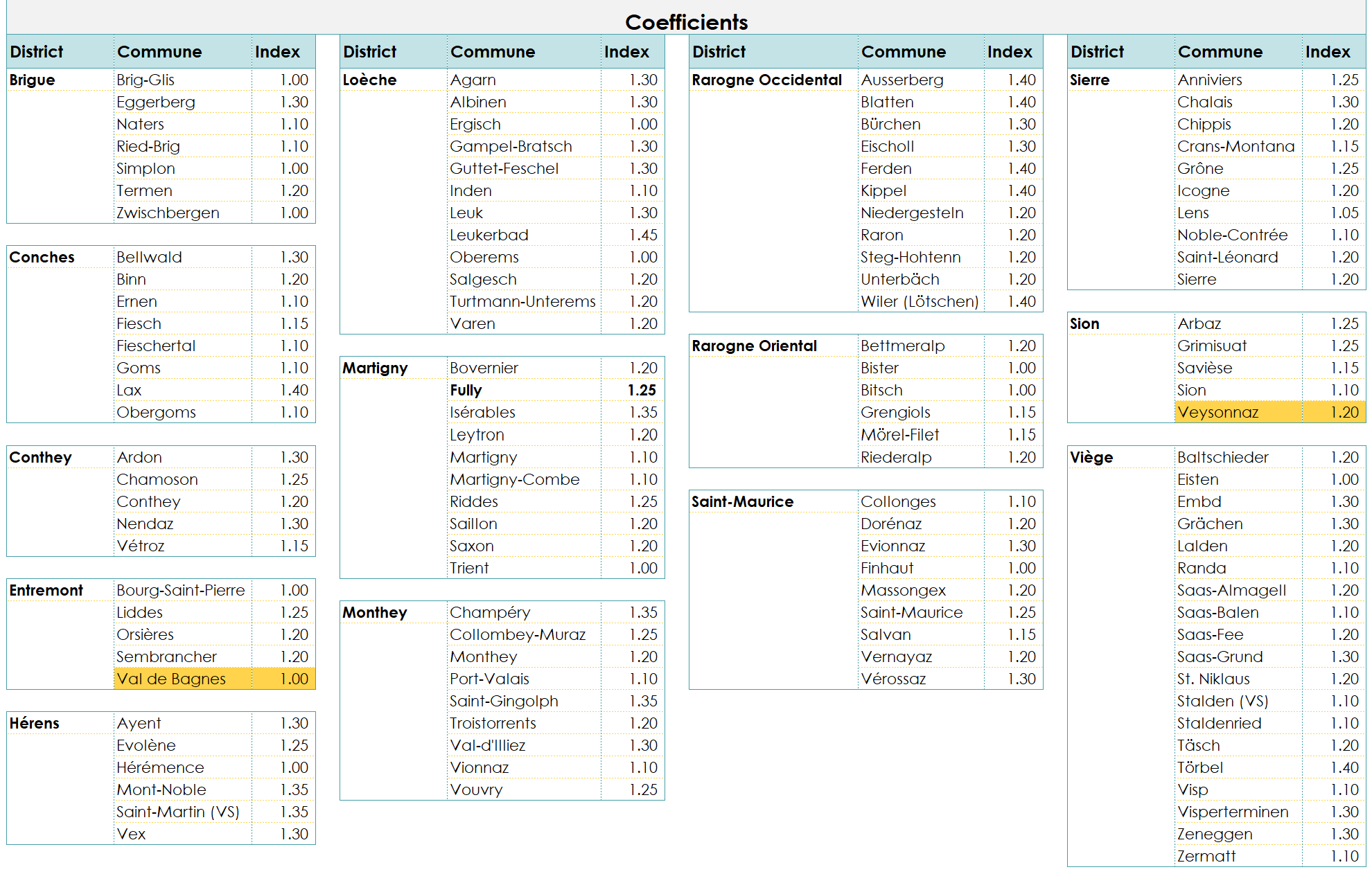

The indé-what? Yes, for those who have already read our article on Valais cantonal income tax… here we are again! Luckily, the same system applies at the municipal level, so the mechanism of deindexation—let’s not shy away from the term—will be similar. However, unlike the cantonal scale, which is uniform across Valais, each of the 122 municipalities has its own index, ranging from 110% to 173% in 2024. This means more or fewer iterations.

For the newcomers, let’s start with the basics. Why has the Valais tax authority decided to use this system and call it such? And why did they opt for such a system in the first place? Even the most curious and determined researchers won’t find a straightforward explanation on Google. To solve this mystery, you’ll need to become acquainted with… DEINDEXATION.

Let’s break it down step by step:

- The Concept: Each municipality in Valais has assigned itself an “indexation percentage,” or simply “index.” This indexation determines the income that will be considered for calculating your tax rate.

- The Range of Indexes: In 2024, municipal indexes range from 110% to 173%. Spoiler alert: for the same income, the higher the index, the lower the tax rate… but the more iterations needed to find this so-called rate-determining income. Yes, that’s the game, my dear Lucette.

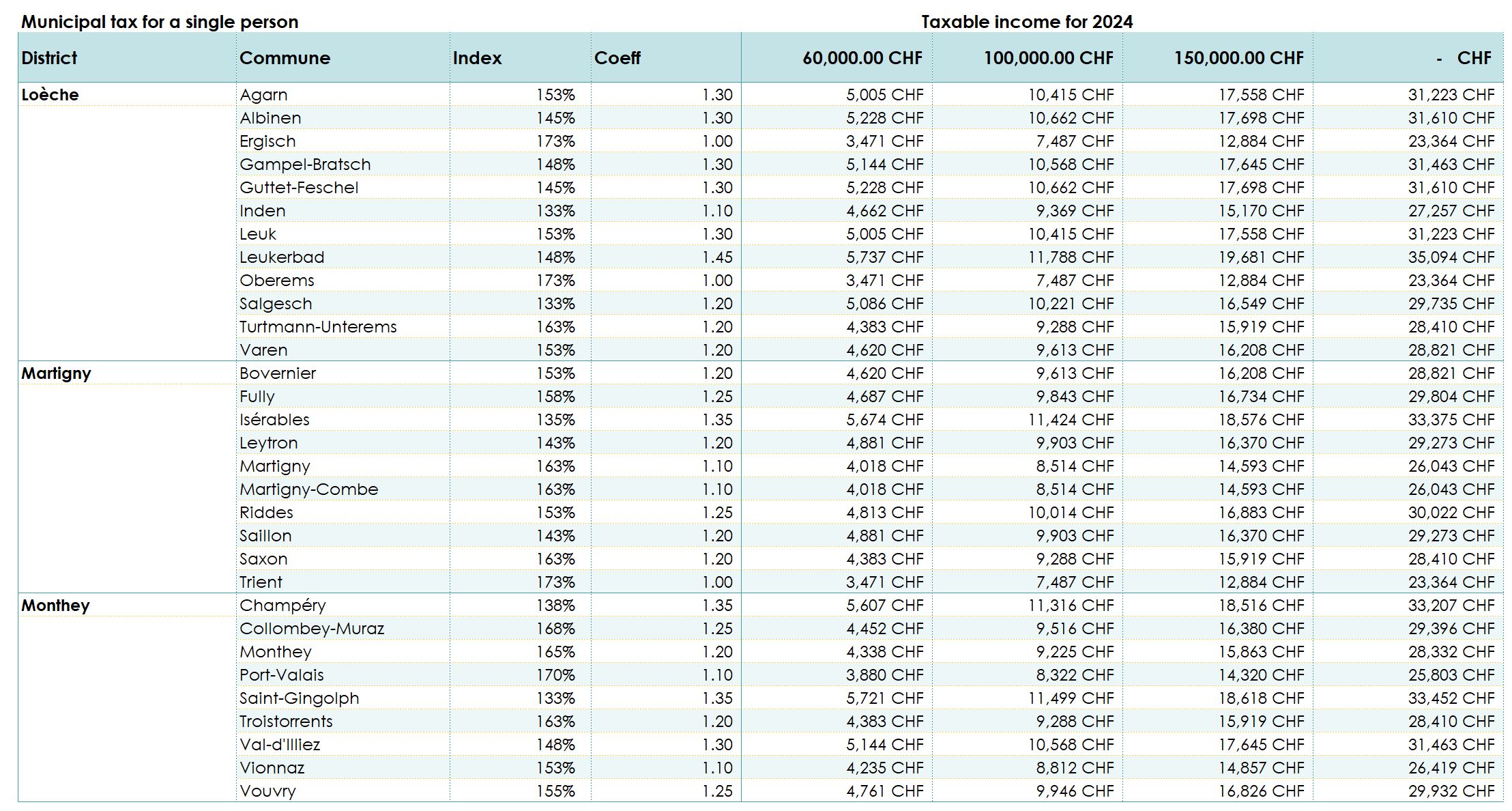

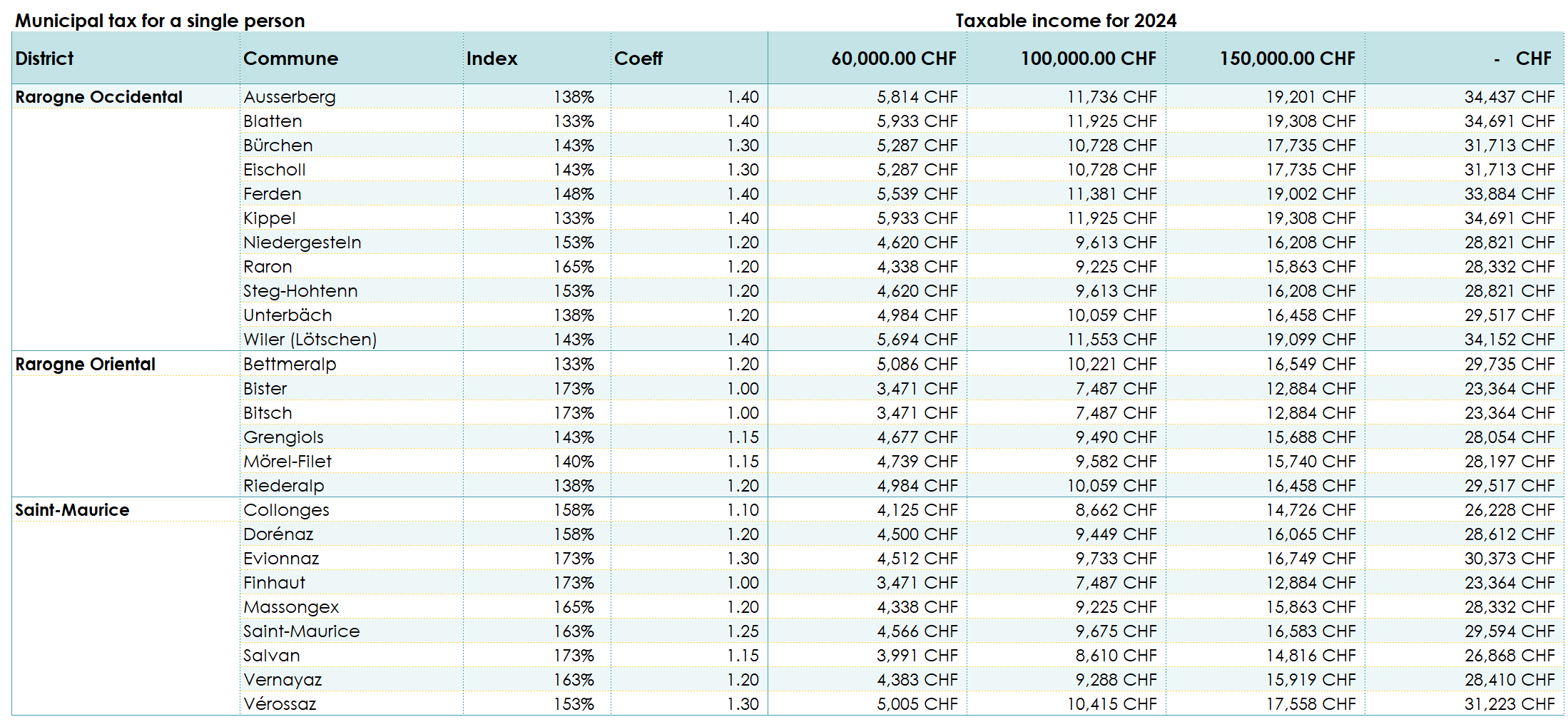

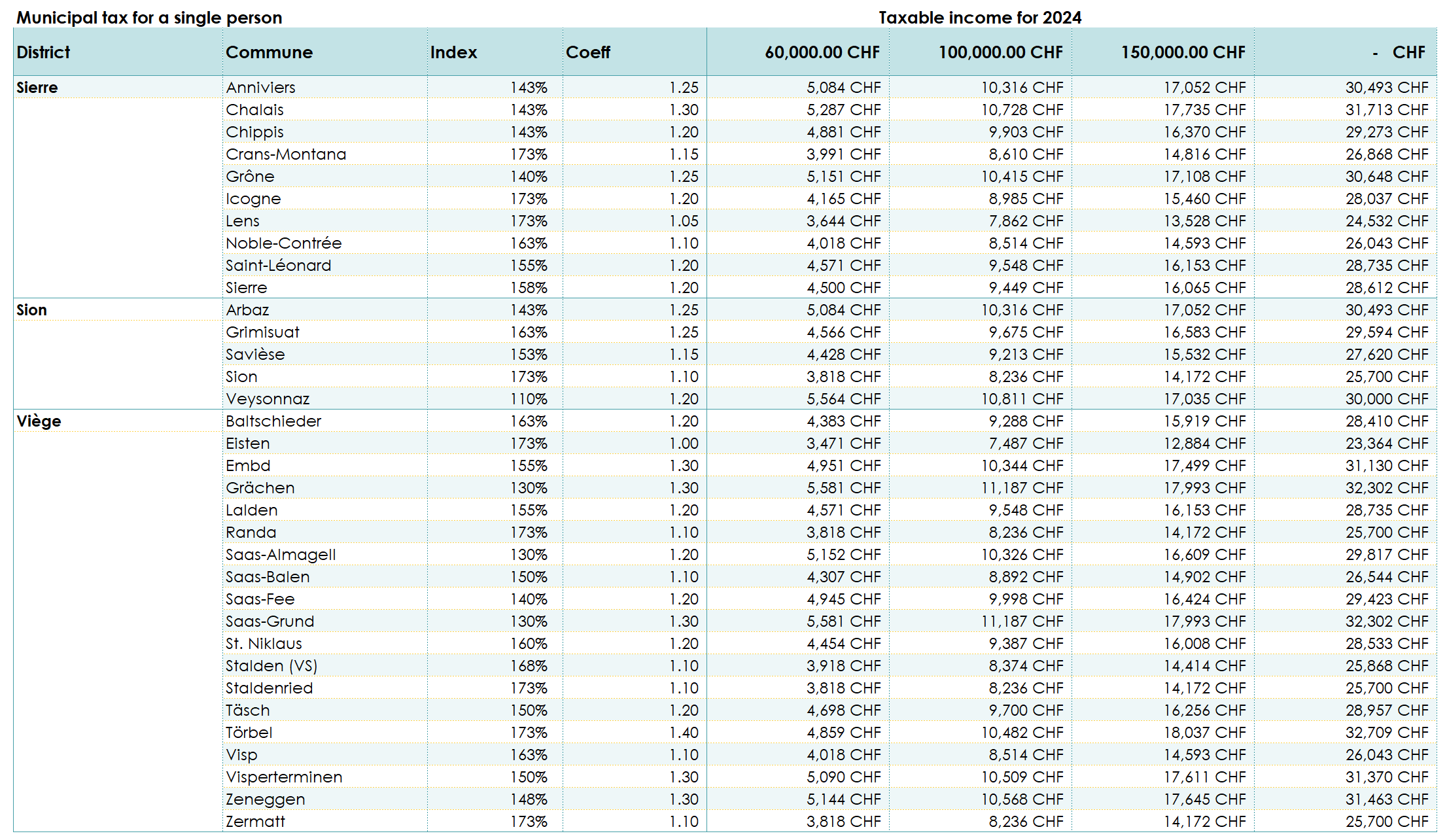

To help you, here’s a table showing the different indexations based on your municipality:

Clarifying Municipal Indexation Through an Example

Yes, it may still seem a bit abstract, but don’t worry—our example will make everything clearer.

👉 Official Municipal Index Table (Link)

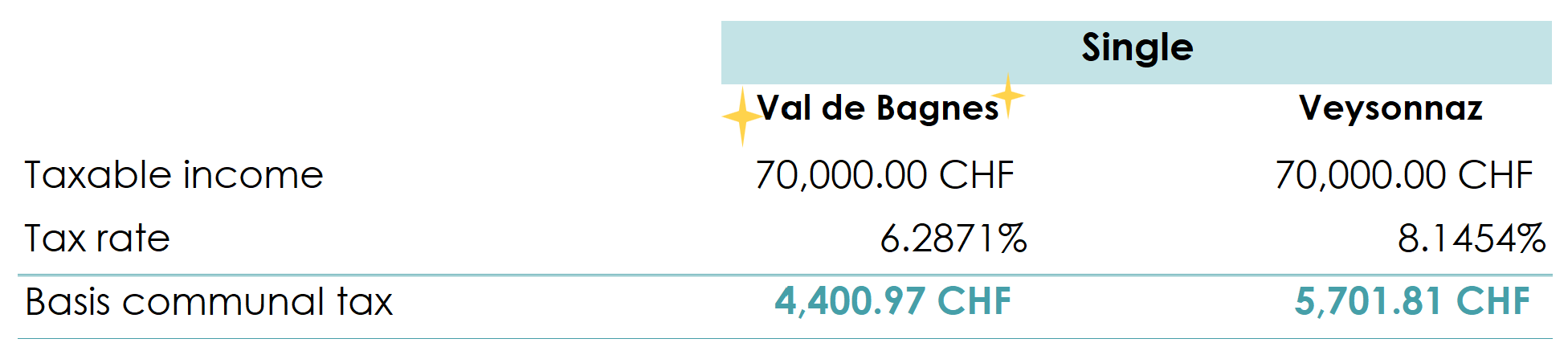

Back to our case: CHF 70,000 of taxable ICC income.

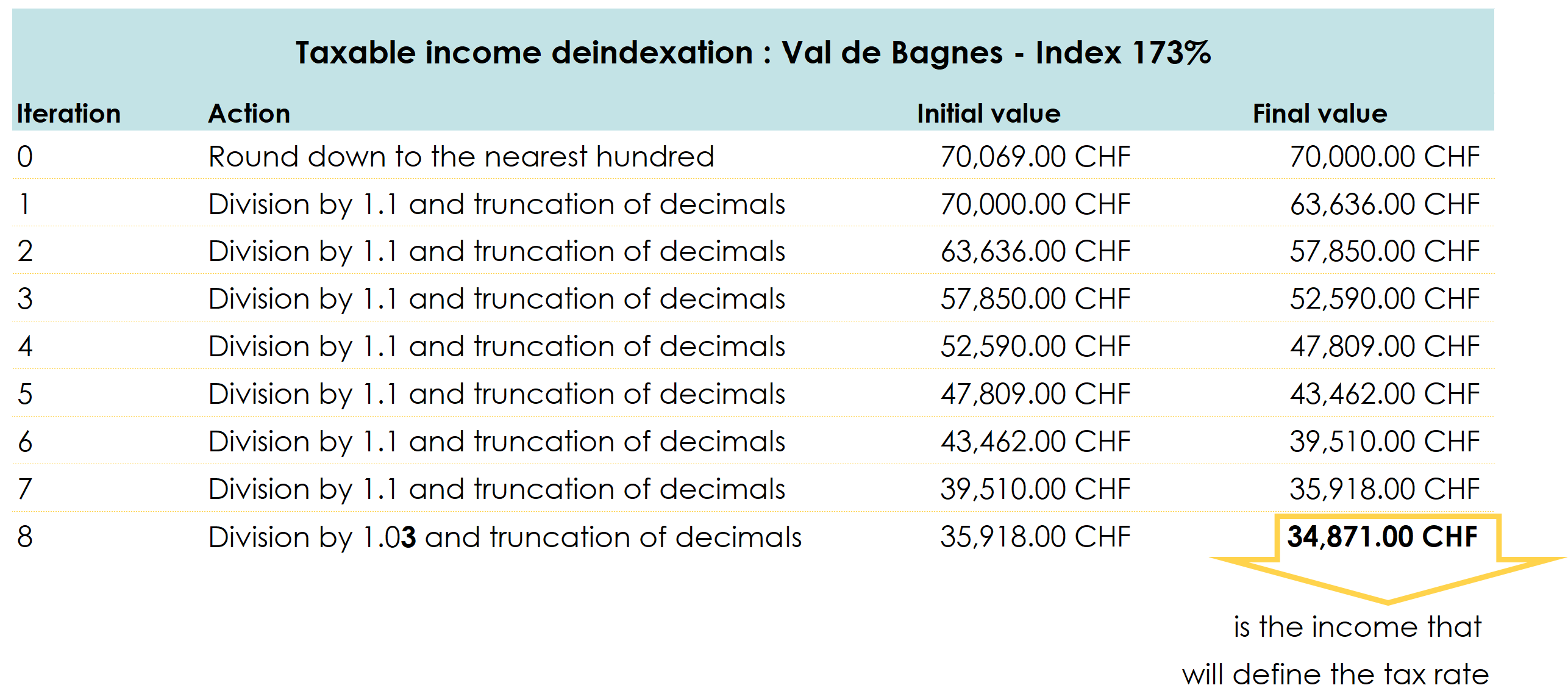

If I had decided to hone my skiing skills in the renowned Verbier resort, located in the Val de Bagnes, I would be dealing with an index of 173%. Here’s how the process would look

- Key Tip: To deindex, divide by 1.1 as many times as there are tens in the index. For Verbier, the index is 173%, so you divide 7 times by 1.1. Don’t forget to truncate the decimals after each iteration (no rounding). Finally, perform one additional division by 1.0X, where X is the number of units in the index (e.g., for 173%, the last division will be by 1.03).

Still unclear? We get it—it’s a complex system. Below, we’ll illustrate the process with detailed calculations.

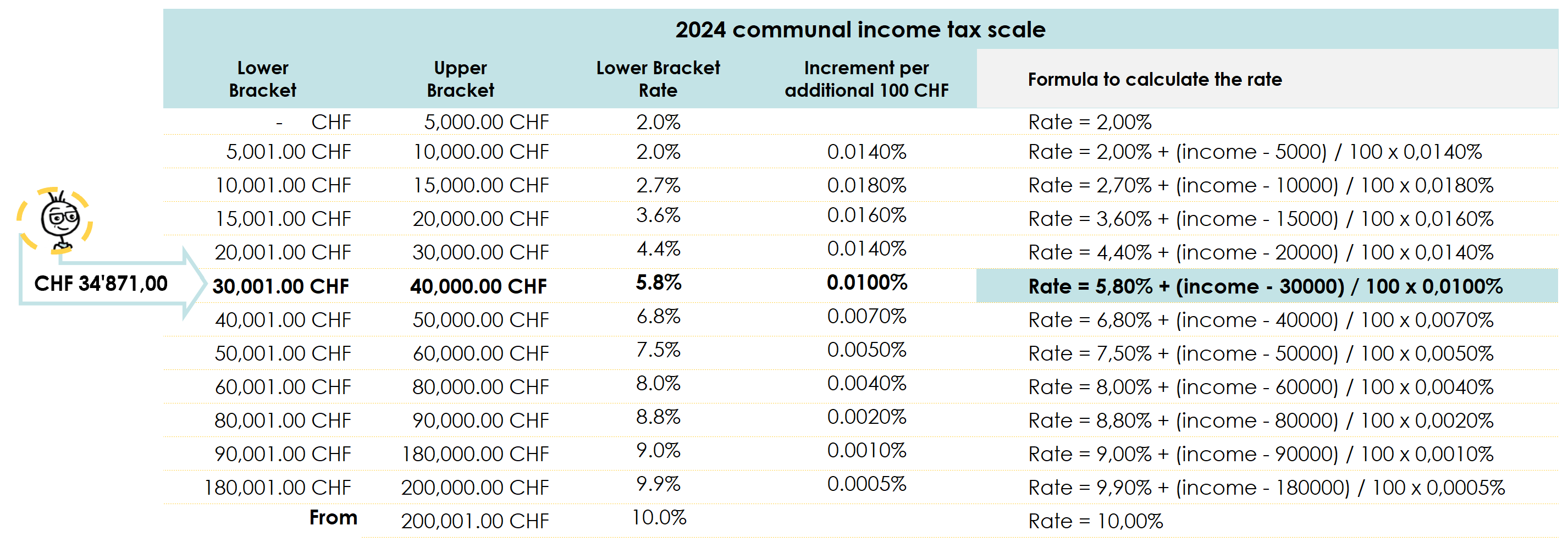

- Finding the Rate: The second step is to find the tax rate corresponding to the de-indexed income in the municipal tax schedule. With a de-indexed income of CHF 34,871, I will apply the following formula to determine my municipal tax rate:

5.80% + (34,871 – 30,000) / 100 * 0.010% = 0.062871, or 6.2871%.

- Calculation of the base tax: My base municipal tax in Val de Bagnes amounts to CHF 4,400.97 (= CHF 70,000 taxable * 6.2871%).

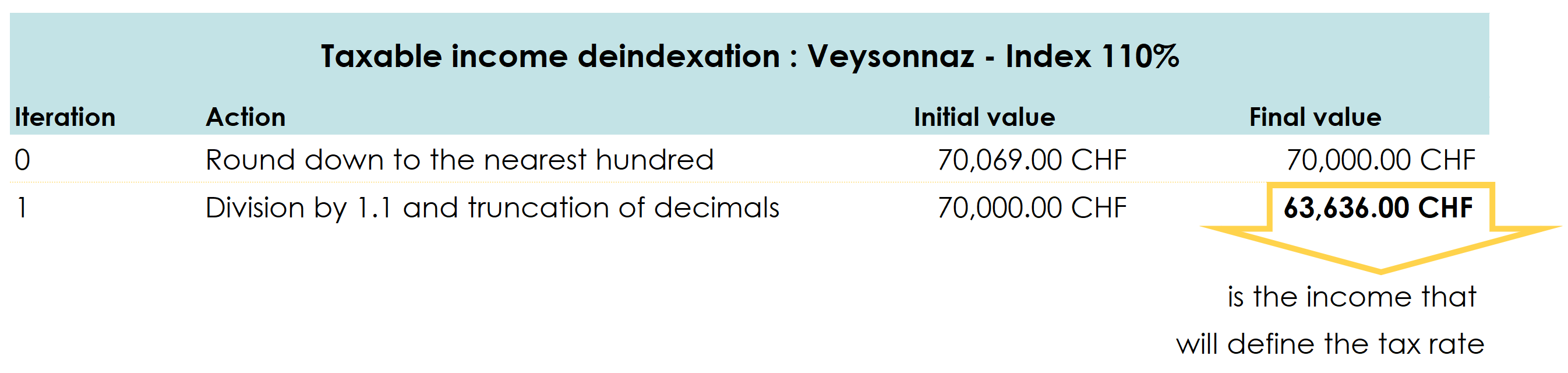

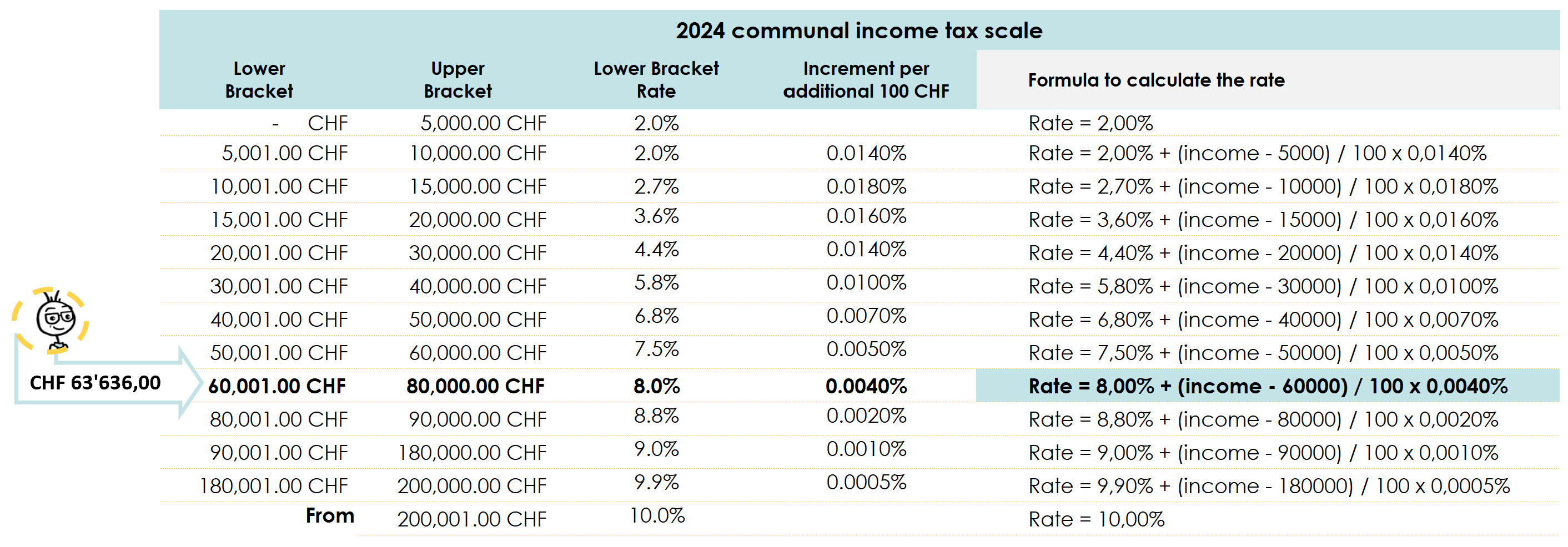

However, if I had chosen to settle in the commune of Veysonnaz, with a view of the Rhône River and the Bernese Alps (Index 110%), the de-indexation process would have been much faster. But at what cost? Let’s see:

Answer: A higher base tax rate: 8.0% + (63,636 – 60,000) * 0.04% = 8.1454%, resulting in a base municipal tax of CHF 5,701.80. This is still CHF 1,700 higher than in Val de Bagnes… Definitely something to think about.

That concludes this first part, which I’ve summarized in the image below.

You now know how the communal indexing works in the canton of Valais.

WARNING: Your base tax is not your final municipal tax! Just a few more lines and you’ll have the full picture.

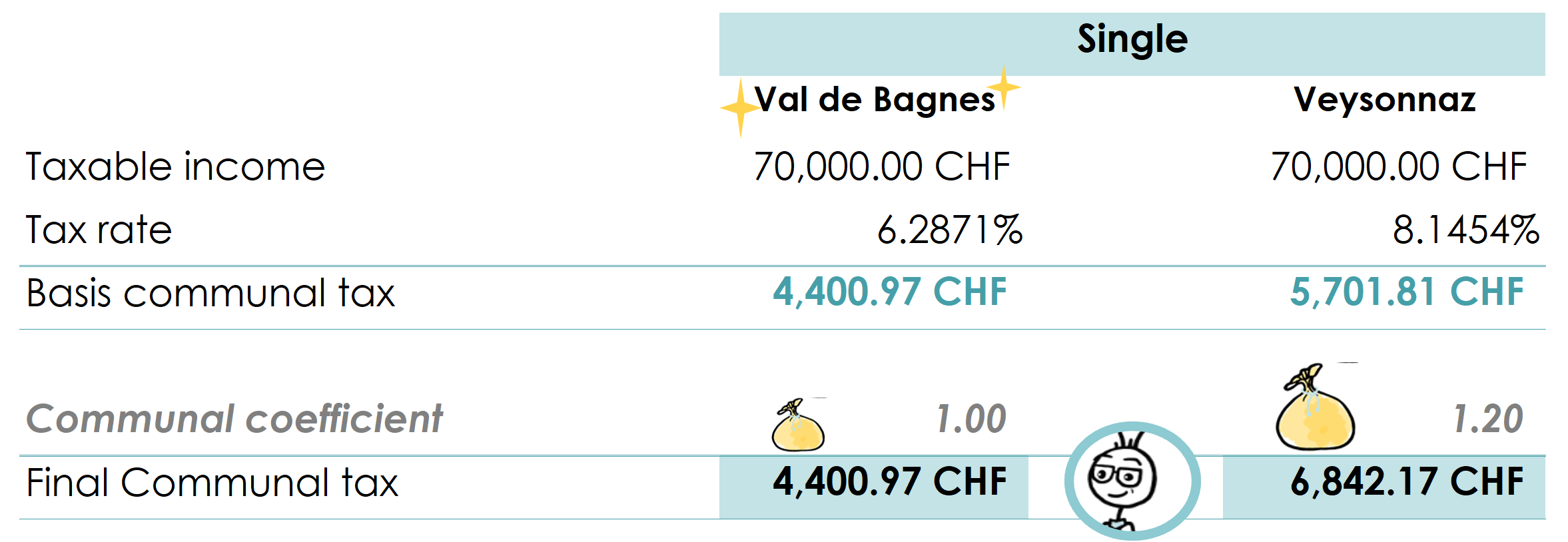

Step 3: The Municipal Coefficient

Here we go again! After the indexing, it’s time for the coefficient…

To be honest, this coefficient doesn’t do much other than adding a bit of extra confusion. But it’s here to multiply the tax calculated through indexing to determine your final municipal tax amount.

So far, we had a simple rule: the higher the indexing, the more iterations there are, and the lower the tax rate. With the coefficient, it’s the opposite: the higher the coefficient, the higher your tax burden will be.

Each municipality has its own coefficient:

Let’s take the same example again, in other words, me deciding between riding in Verbier in the Val de Bagnes (Coefficient 1) or having my coffee with the best view in Switzerland in Veysonnaz (coefficient 1.20).

In the first case (Verbier), I had a base tax of 4,400.97 CHF, so I simply need to multiply this figure by 1, which gives us: 4,400.97 CHF.

On the other hand, with a coefficient of 1.20, the tax becomes 5,701.81 CHF × 1.20 = 6,842.17 CHF.

And there you go, friends, the Valaisan municipal tax has no more secrets for you!

Finally, not quite… you’ve probably thought the same thing I did. Is it better to look at the coefficient to make my choice? Or the indexation?

Coefficient or indexation, what should you look at to optimize your income tax?

It’s always interesting to know whether the commune where we want to live offers competitive tax advantages.

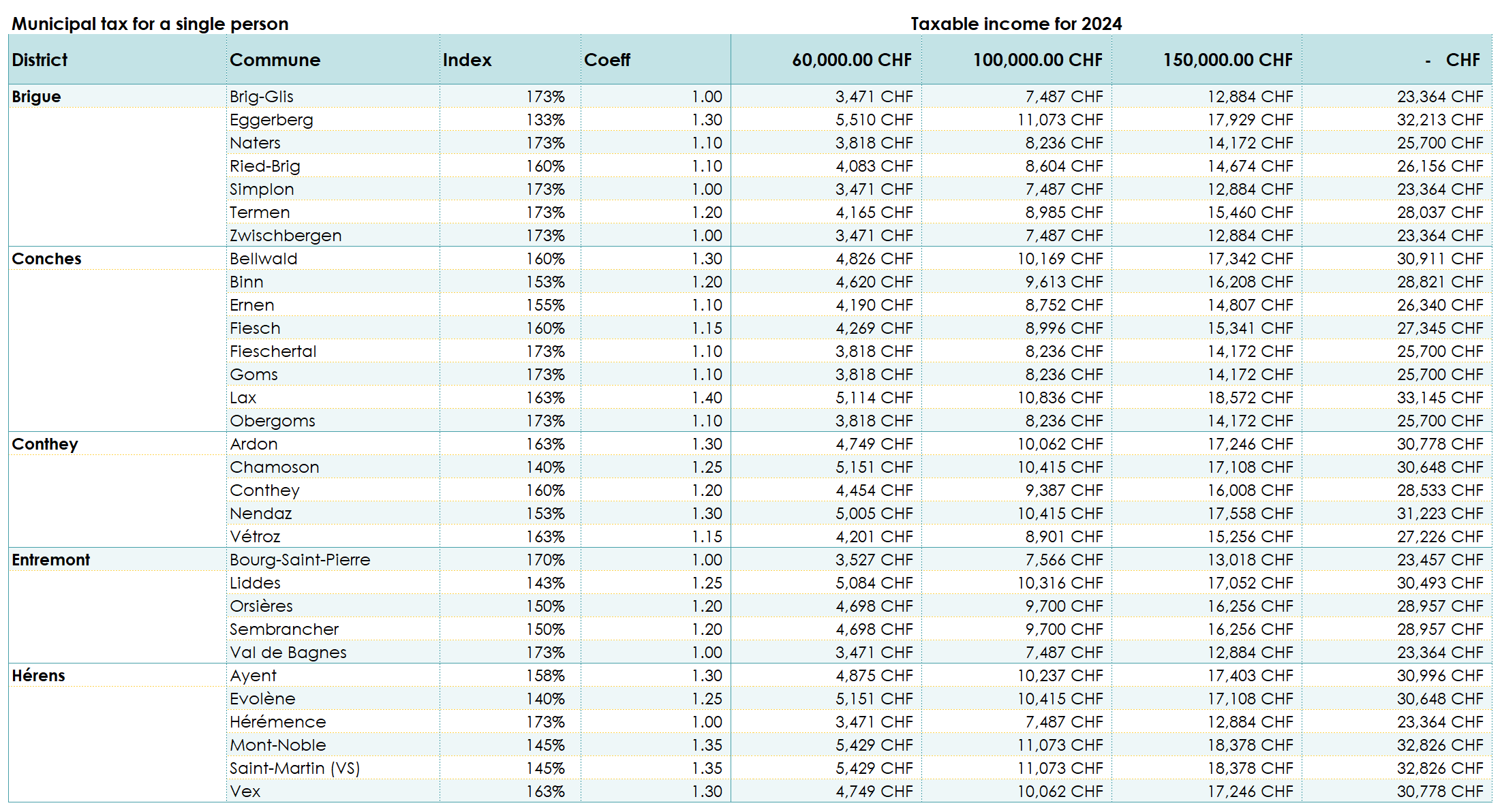

To do this, it’s necessary to take each index and each coefficient and apply them to a taxable income.

After a loooong hesitation (after going through the same steps as I did, you probably know why), we did it. Below, you’ll find four photos with the tax rate and the tax amount for taxable incomes of 60,000 CHF – 100,000 CHF, and 150,000 CHF for all Valaisan communes.

You can then look up your commune and see the potential tax burden you carry compared to your neighbors.

Conclusion?

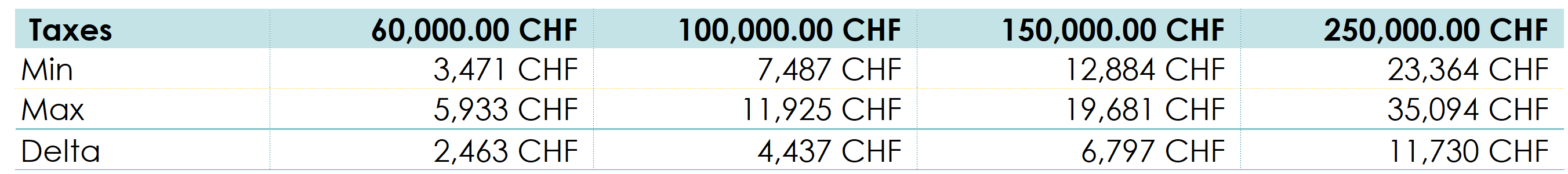

The most important conclusion is that the commune you choose can have a significant impact on your savings.

For taxable incomes of 60,000 CHF, the difference in tax amounts to 2,463 CHF per year.

This difference is even greater when taxable incomes reach 150,000 CHF. The commune with the highest tax rate will require an additional 6,797 CHF.

In fiscal terms, choosing the right commune can save you between 4% and 5% of your income.

How Does Marriage Affect Municipal Income Taxes?

Have you read our article on cantonal taxes in Valais? If so, I suggest you move on to Valais’ wealth tax because the impact of marriage at the cantonal and municipal level is the same.

However, if you haven’t, here’s a quick recap:

The tax benefit related to marriage is calculated based on the tax you would have paid as a single person. Once this amount is known, the communes agree to disregard 35% of this amount.

However, there are two rules:

- Rule 1: The deduction cannot be less than 680 CHF. In other words, if your taxable income is below 40,000 CHF, you can benefit from a 680 CHF tax deduction.

- Rule 2: The deduction cannot exceed 4,870 CHF. This means that if your taxable income exceeds 123,200 CHF, you won’t be able to claim a higher deduction.

Between these two thresholds, you can subtract 35% of your tax liability.

How Do Children Affect Your Municipal Taxes?

It’s simple: children do not affect the calculation of your taxes. Unlike other cantons like Vaud, which allows for a reduction in the tax rate through the family quotient family quotient in Vaud, Valais communes make no distinction whether you have children or not.

However, I didn’t say that children don’t provide any tax benefits! This only concerns the calculation of the tax, which is not directly impacted.

Nevertheless, having children allows you to lower your taxable income through authorized deductions, such as:

- Childcare costs

- Child allowances

- Etc.

Calculating Your Total Taxes in Valais: ICC + IFD

In this chapter, we’ve explained how municipal taxes work. We hope that now you are able to simulate them. However, to know the total tax bill in Valais, you’ll need to add the cantonal taxes and the federal direct tax.

Oh, and I almost forgot… In these articles, we’ve only talked about income tax, but it’s important to always remember that in Switzerland, unlike in most countries, there is also wealth tax (even for Valais residents)!

How Can FBKConseils Help You?

A Free First Consultation

If after reading our articles, you still have unanswered questions, we offer a free consultation lasting 15 to 30 minutes. This meeting will help you deepen your understanding of Valais taxes.

Tax Simulations

Although you now have all the necessary information to perform your own tax simulations, we are here to assist you. Whether it’s verifying your calculations or simply delegating this task, FBKConseils is happy to support you.

Tailored Tax Returns

Whether you want to learn how to file your taxes optimally or simply want to delegate the task, FBKConseils will adapt to your needs and provide the necessary support. We are here to simplify your tax return.